When going through divorce, one of the toughest things to figure out is what to do with the family home. Do you think you want to keep your house but aren't totally sure? This three-step process will help you make the decision that is right for you. However, we strongly suggest that you discuss this process with your legal and tax advisors.

The emotional role of the house in a divorce

The family home often takes on a central, even mythical, role in popular culture. The home is the place where good memories are made and happy endings are the norm. Boomers had the crisply starched, black-and-white, center-hall Colonial perfection of "Leave It to Beaver." Gen X adored "The Brady Bunch" ranch in all its avocado, orange and wood-paneled glory. Millennials fancied themselves inside one very "Full House" in San Francisco.

It's only natural to idealize your home life, often the backdrop for your marriage's happier times. However, it's important to get a handle on the financial implications that come with taking on sole ownership of a home and how emotional the topic of the family home can be during divorce-settlement discussions.

Those emotions can be difficult because they come precisely when you need to be as objective as possible—when deciding who gets the house in a divorce where children are involved.

My clients and I use a three-step approach to help them make a clear, rational decision about keeping or letting go of the house in a divorce. This process is geared toward bringing rationality and clarity to the decision to keep or let go of the home.

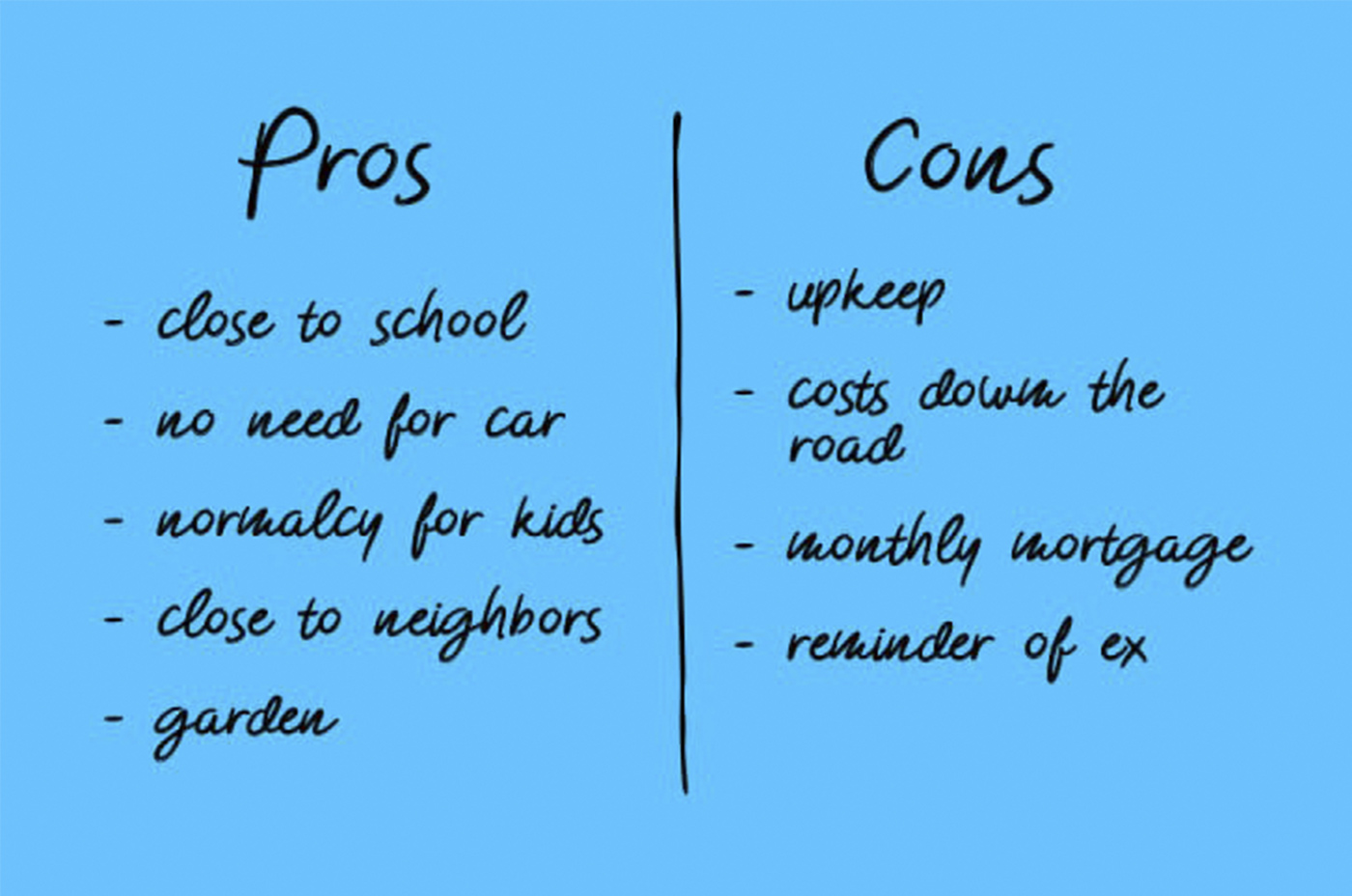

Take Jasmine. Jasmine and her husband Terrance have lived in their home for 15 years, with their two children. Their children were settled in comfortably—setting up a treehouse in the backyard, biking to school and developing friendships with neighborhood children. When the couple first got married, they purchased the home from Jasmine's family. During the divorce, Jasmine was emotionally attached to the home because it had family history and was loved by her children. She evaluated her finances and determined if she cut costs in other areas, she would be able to pay the mortgage on her house with a single income. Though she was emotionally invested in the house, it was also a sound financial investment.

When it comes time to decide who gets the house in a divorce and how to negotiate fairly with the other party, consider taking the following steps:

1. Evaluate your reasoning for keeping the house in a divorce

The first step in deciding whether to pursue the family home is to understand why you want to be the one who gets to stay in the house during a divorce—or why you don't.